China has recently unleashed a wave of powerful stimulus measures aimed at propping up its slowing economy and reviving market confidence. These actions, timed just before the country’s 75th National Day celebration, include aggressive monetary easing, liquidity injections, and new support mechanisms for the stock market. Investors are asking: Is this “bazooka” enough to reignite sustainable economic growth? Or is it merely a temporary boost masking deeper structural problems? In this blog, we’ll explore these questions and analyze the underlying data from the latest economic indications.

The “Bazooka” Measures: What Happened?

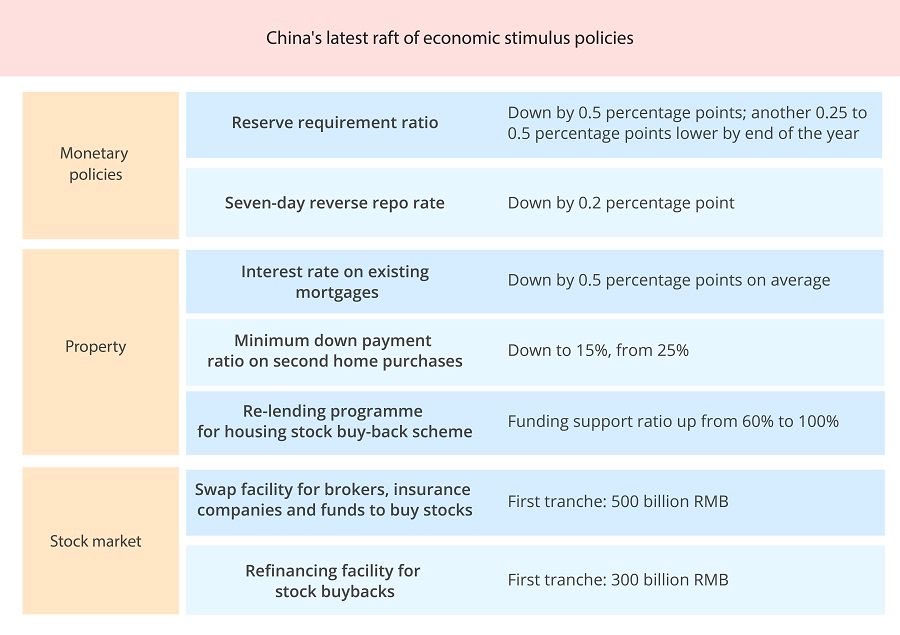

On September 24, 2024, China’s policymakers launched a comprehensive stimulus package designed to reverse the economic slowdown. These measures included:

1. A 50bp Reserve Requirement Ratio (RRR) cut, providing RMB 1 trillion in long-term liquidity to the banking system.

2. A 20bp cut to the 7-day reverse repo rate and a 30bp cut to the 1-year Medium-Term Lending Facility (MLF) rate, both aimed at lowering borrowing costs.

3. A RMB 500 billion stock market intervention via the People’s Bank of China (PBoC), with the promise of doubling the amount if needed. This is a novel approach, as past interventions targeted state-owned financial institutions, not the broader stock market.

4. Lowering deposit rates to protect bank profit margins amid these easing measures. 5. Mortgage rate reductions, which will provide relief to heavily indebted households.

5. Mortgage rate reductions, which will provide relief to heavily indebted households.

In the days following the announcement, these policies triggered a sharp market rebound, lifting Chinese equities into a technical bull market in a matter of days.

Yet, the larger question remains: Can these stimulus efforts tackle the root causes of China‘s economic slowdown?

China’s Structural Challenges: A Closer Look

Despite the bold policy moves, China’s economy is facing deep structural issues that go beyond short-term liquidity shortages.

1 The collapsing of consumer confidence

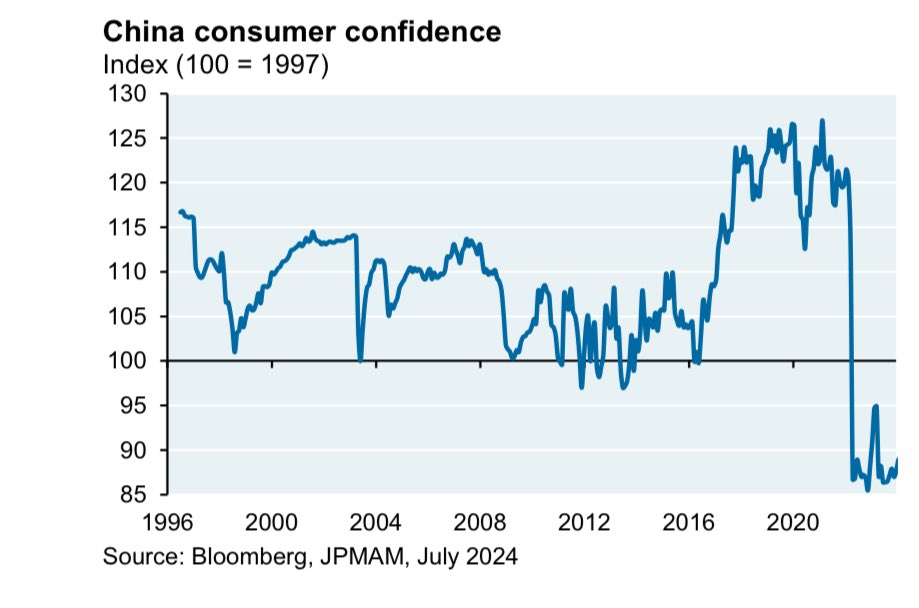

According to the chart, consumer confidence has plunged to its lowest levels in decades. A sharp decline post-2020 has left households cautious, with spending curtailed and uncertainty looming large.

Consumer sentiment is critical to economic recovery, especially in geopolitical risk driven foreign business decoupling Chinese market. When consumers are hesitant to spend, demand falls, leading to weaker growth in key sectors such as retail, services, and housing. The stimulus package may provide a temporary boost to confidence, but the broader trend suggests deep-seated anxieties.

2 The Real Estate Sector: De-Leveraging and Deflation

A significant part of China’s economic woes stems from its real estate sector, which has been the primary engine of growth for over two decades.

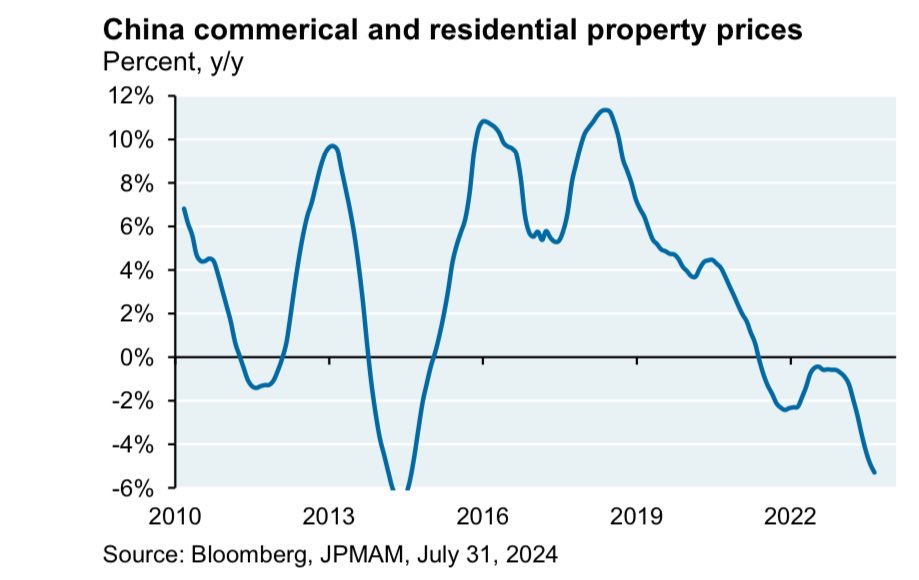

As shown in Chart China Commercial and Residential Property Prices, the property market has seen a sharp drop since 2021, with both commercial and residential prices declining year-over-year. This deflationary trend is particularly troubling because real estate accounts for nearly 30% of China’s GDP. The collapse has hit household wealth hard, with economists estimating over $10 trillion in wealth losses.

– This sector’s downturn has sparked widespread defaults among developers, halted construction projects, and weakened consumer and business sentiment.

– Real estate weakness ripples across the economy, affecting industries like steel, cement, and home furnishings, not to mention local governments that rely on land sales for revenue.

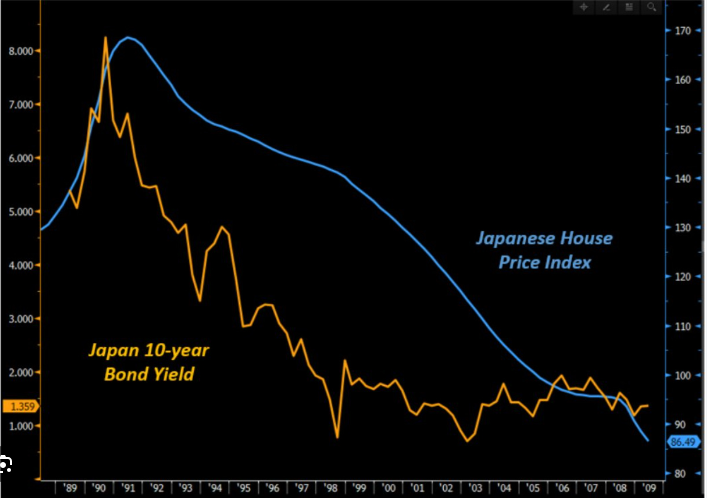

The property sector’s deep de-leveraging suggests that even aggressive monetary easing might not be enough to reverse the trend. And this can be learnt from Japanese experience with interest rate stay for near zero several decades, but the property price stay down.

Don’t leave your passport in a safe.

As shown in Chart China Commercial and Residential Property Prices, the property market has seen a sharp drop since 2021, with both commercial and residential prices declining year-over-year. This deflationary trend is particularly troubling because real estate accounts for nearly 30% of China’s GDP. The collapse has hit household wealth hard, with economists estimating over $10 trillion in wealth losses.

– This sector’s downturn has sparked widespread defaults among developers, halted construction projects, and weakened consumer and business sentiment.

– Real estate weakness ripples across the economy, affecting industries like steel, cement, and home furnishings, not to mention local governments that rely on land sales for revenue.

The property sector’s deep de-leveraging suggests that even aggressive monetary easing might not be enough to reverse the trend. And this can be learnt from Japanese experience with interest rate stay for near zero several decades, but the property price stay down.

3 Liquidity and Credit Growth: The M2 Money Supply Problem

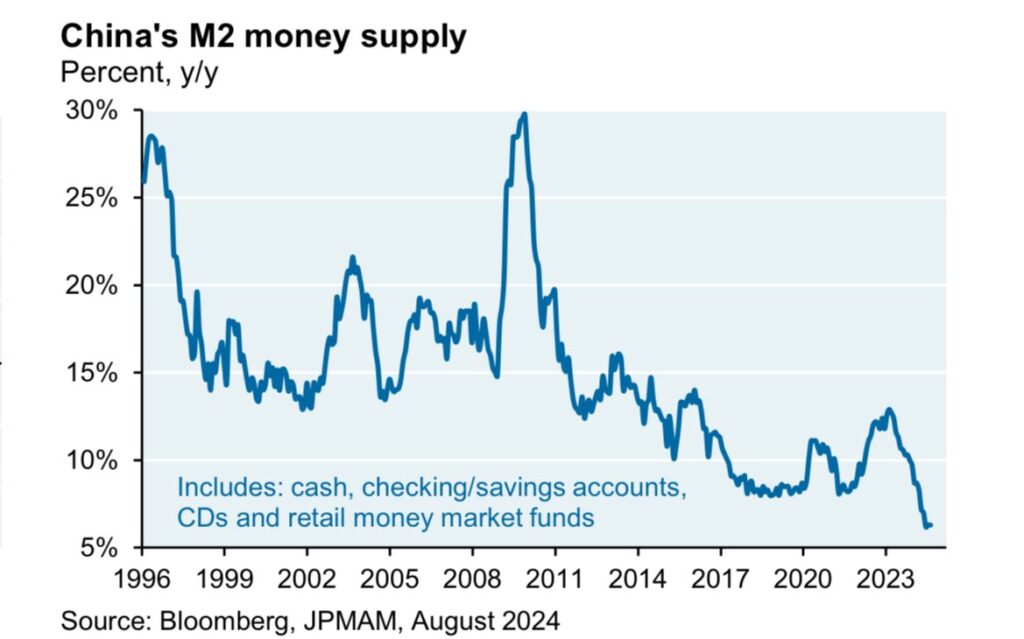

Another crucial indicator of China’s economic fragility is the declining M2 money supply growth. As shown in Chart : China’s M2 Money Supply, the growth rate of the money supply has been on a steady downward trajectory, reflecting tightening liquidity conditions. The recent RRR and rate cuts are attempts to address this, but the data shows a broader problem—credit growth is slowing, and businesses are becoming reluctant to borrow in a climate of economic uncertainty.

This decline in money supply could act as a significant headwind to any recovery. Although the PBoC’s actions aim to inject liquidity, the effects may be limited if consumers and businesses remain risk-averse. To truly stimulate lending and investment, more expansive fiscal policies or direct government intervention may be necessary.

Is the “Bazooka” Enough?

While the latest stimulus measures have provided a much-needed jolt to the financial markets, it’s unclear whether they can address the deep structural issues plaguing China’s economy. Consumer confidence remains at historic lows, the real estate market is in freefall, and liquidity is tightening despite monetary easing.

China’s situation mirrors that of Japan in the 1990s, when aggressive rate cuts failed to revive an economy suffering from a balance sheet recession. China, like Japan, may find that monetary policy alone cannot solve its economic problems. The country has already tapped out its corporate and household sectors for growth through debt, and now it faces the challenge of deleveraging without triggering a full-blown economic crisis.

Conclusion: The Need for Fiscal Firepower

China’s recent actions should not be underestimated. The PBoC’s promise to inject another RMB 500 billion into the stock market if necessary shows that policymakers are serious about boosting confidence. However, as history has shown, monetary easing is not a cure-all.

For China to achieve sustainable growth, fiscal stimulus will be essential. Large-scale public spending on infrastructure, social welfare, and possibly even direct support for the housing market will be needed to restore long-term stability. Without such measures, the recent “bazooka” may provide only a temporary respite before deeper economic challenges resurface.

For investors, the short-term outlook might seem bullish, but caution is advised. Structural weaknesses remain, and a long-term solution will require more than just rate cuts and liquidity injections. As China continues to navigate these economic challenges, it’s crucial to stay informed and agile in investment decisions.

Stay tuned to our investment advisory for further updates on China’s evolving economic landscape and how it may impact global markets.

Winfort Capital Research

02 October 2024