In recent years, the meteoric rise of technology stocks has reshaped the landscape of investment portfolios, particularly those driven by index funds. The allure of passive investing has led many to believe that it’s a set-and-forget strategy. However, as market dynamics evolve, it becomes crucial to re-examine the implications of this approach, especially in light of changing sector weightings and the timing of sector peaks.

Index Investing: The Active Strategy Behind the Passive Façade

Index investing is often perceived as a passive strategy, but in reality, it operates with an active undertone. The strategy, particularly in market cap-weighted indexes, revolves around “just buying the biggest stocks.” This approach has gained popularity due to its simplicity and cost-effectiveness, leading to a dominant share of total funds under management being funneled into passive funds.

However, this strategy’s success has inadvertently skewed investors’ portfolios toward the largest sectors—most notably, technology. While this has paid off in a winner-takes-all market environment, it also introduces significant risks. A deeper dive into the current sector weightings reveals a startling overexposure to tech stocks and an underweighting in traditionally defensive sectors like utilities, consumer staples, and healthcare.usiness trip, make sure to travel prepared. My travel kit always includes tons of medicine. I don’t want to catch something while out on the road, so I’m prepared for anything!

The Chart Tells a Sobering Story

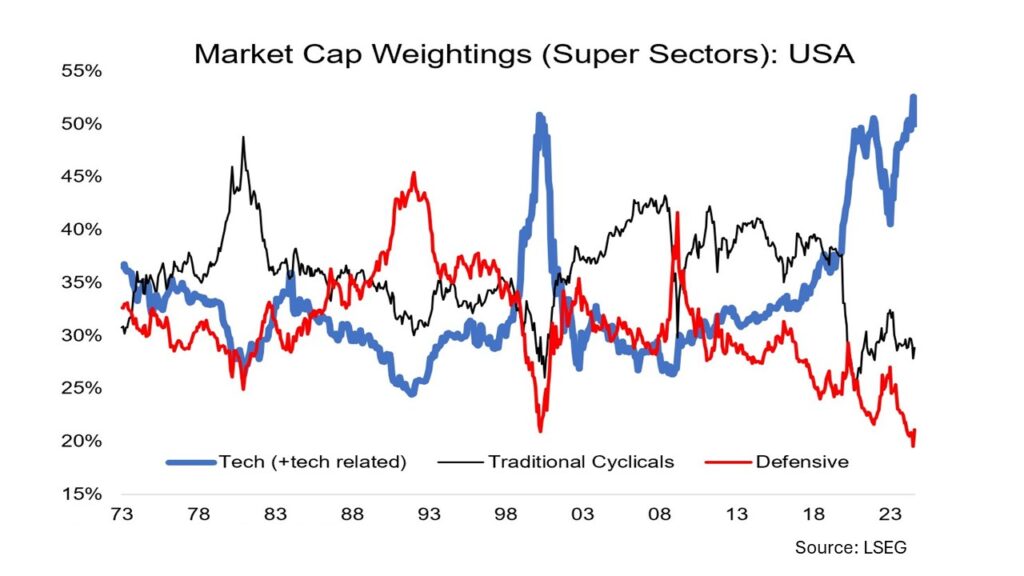

A recent analysis of sector weightings in a typical U.S. market cap-weighted equity index paints a clear picture. The chart shows that nearly 50% of the index is now concentrated in tech and tech-related sectors. This dominance reflects the extraordinary growth of tech giants, but it also means that index investors are highly exposed to the fortunes of a single sector.

Conversely, the chart highlights a record low weighting in defensive sectors. These sectors, which include utilities, consumer staples, and healthcare, are known for their stability during economic downturns. They tend to hold value or even gain ground when the broader market declines. The underrepresentation of these sectors in the index leaves investors with reduced protection against market volatility.

The implications of this imbalance are profound. With a heavy tilt towards tech, the index—and by extension, investors’ portfolios—are vulnerable to any downturn in the tech sector. The reduced exposure to defensive sectors exacerbates this risk, potentially leading to more significant losses in a market correction.

Understanding Sector Peaks: Timing is Everything

The concentration in tech and the underweighting of defensives bring another critical factor into play: the timing of sector peaks. Historically, different sectors peak at different stages of the economic cycle. For instance, tech stocks often peak during periods of economic expansion, driven by increased consumer and business spending. On the other hand, defensive sectors tend to peak later in the cycle or during downturns, as investors seek stability and lower volatility.

The time gap between these peaks can vary, but empirical data suggests that it typically ranges from 12 to 18 months. This gap is crucial for investors to understand, as it highlights the importance of sector rotation and timing in managing portfolio risk. In some cycles, the gap between the peak of a leading sector like tech and a lagging sector like utilities might be short, especially in rapidly changing markets. In others, the gap could be longer, reflecting prolonged phases of growth or contraction.

Rebalancing for Resilience

Given the current market dynamics, it’s imperative for investors to reconsider their sector allocations. The heavy concentration in tech and the reduced weighting in defensives signal a need for rebalancing. By diversifying into more defensive assets or increasing exposure to non-correlated sectors, investors can mitigate the risks associated with an overreliance on tech.

In conclusion, while index investing remains a popular and successful strategy, it’s not without its pitfalls. The current sector weightings in major indexes underscore the need for vigilance and proactive management. By understanding the timing of sector peaks and adjusting allocations accordingly, investors can better navigate the challenges of today’s market and build more resilient portfolios for the future.

Winfort Capital Research

2 Aug 2024

Good https://t.ly/tndaA