The recent return of Donald Trump as U.S. President has sent ripples through global financial markets, sparking significant volatility across equities, bonds, and commodities. For high-net-worth (HNW) investors, understanding the potential implications of “Trumponomics 2.0” is crucial to positioning portfolios strategically in this new economic and political landscape.

Key Themes and Investment Opportunities

1. U.S. Equities Poised for Favorable Policies

Trump’s pro-business stance, encompassing tax cuts and deregulation, could provide a substantial tailwind for U.S. stocks. Key beneficiaries include:

- Banking and Financials: Higher interest rates and reduced regulation may improve profitability.

- Defense and Fossil Fuels: Increased military spending and deregulation of energy production support growth.

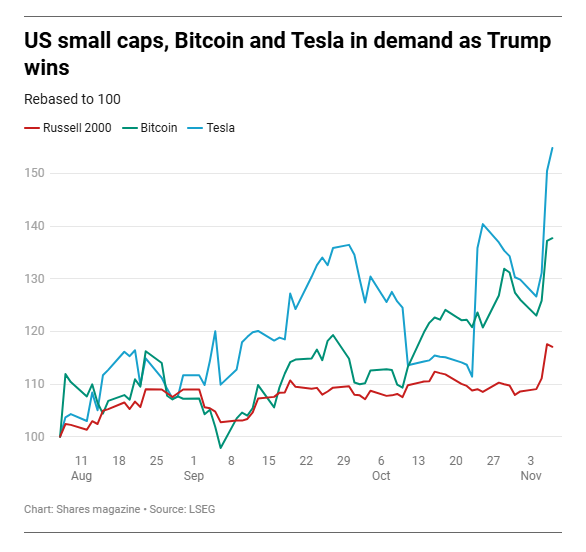

- Technology and Crypto: Companies like Tesla and Bitcoin-related investments could thrive under Trump’s focus on innovation and cryptocurrency support.

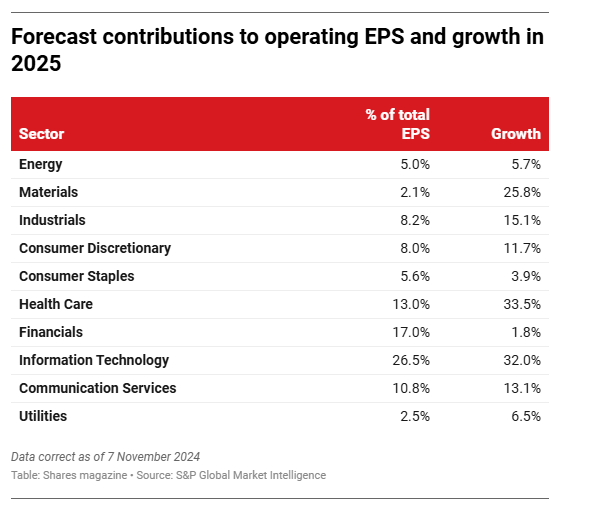

However, heightened valuations in U.S. equity markets, particularly in sectors like technology and healthcare, demand cautious optimism. Diversification within these sectors may mitigate potential risks.

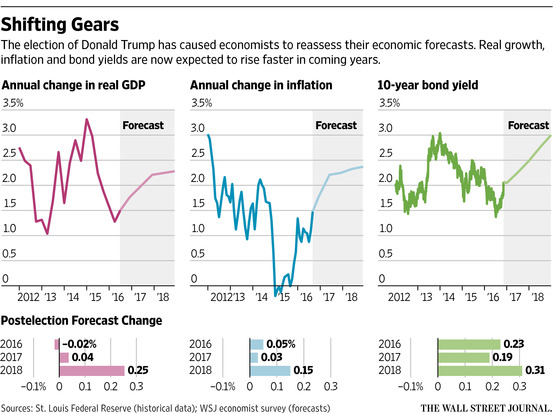

2. Trade Policies and Inflation Risks

Trump’s emphasis on tariffs, particularly against China, is likely to reignite trade tensions. Key implications include:

- Supply Chain Disruption: Companies reliant on global supply chains could face higher costs, impacting profit margins.

- Rising Consumer Prices: Tariffs may increase the cost of imported goods, potentially fueling inflation.

Investors might consider focusing on small-cap U.S. companies with a domestic focus, as they are less exposed to global trade uncertainties and may benefit from protectionist policies.

3. Fixed Income Challenges

The anticipated rise in U.S. fiscal deficits, coupled with sticky inflation, could put upward pressure on Treasury yields. This environment presents challenges for fixed-income portfolios:

- Rising Borrowing Costs: Increased yields may reduce bond prices, leading to potential capital losses for fixed-income investors.

- Selective Opportunities: Inflation-linked bonds and high-quality corporate debt may offer better risk-adjusted returns.

4. Energy Transition Setbacks

Trump’s rollback of green initiatives and push for traditional energy production may slow progress on climate goals. Implications include:

- Fossil Fuel Investments: Oil, gas, and coal stocks could benefit from deregulation.

- Renewable Energy Headwinds: Sustainability-focused funds may face challenges, as momentum shifts away from green technologies.

HNW clients with sustainability commitments should explore international opportunities in renewable energy and consider balancing traditional energy investments with ESG-compliant alternatives.

Broader Macroeconomic Implications

1. Stronger Dollar, Rising Interest Rates

Trump’s policies could reinforce the dollar’s strength in the short term but increase fiscal pressures in the long run. This dynamic favors:

- U.S. Dollar-Denominated Assets: Investors may benefit from short-term dollar appreciation.

- Challenges for Emerging Markets: Higher U.S. rates and a stronger dollar may strain emerging market debt and equity markets.

2. Soft Landing Potential with Growth Risks

While some predict a soft landing for the U.S. economy, the combination of tax cuts and tariffs may harm long-term growth. Investors should monitor:

- Sector-Specific Earnings: Health care, technology, and materials sectors project strong growth.

- Valuation Concerns: Elevated P/E ratios in U.S. markets suggest limited room for error in economic policymaking.

Staying Balanced Amid Uncertainty

Global financial markets are bracing for a period of increased volatility and unpredictability. For HNW investors, maintaining a balanced portfolio and adhering to long-term investment principles are key to navigating this environment.

Actionable Takeaways:

- Diversify geographically and across asset classes to manage risk.

- Focus on sectors and industries likely to benefit from Trump’s policies, while hedging against inflation and trade risks.

- Maintain liquidity to capitalize on emerging opportunities during periods of volatility.

By staying informed and proactive, you can ensure your portfolio remains resilient and well-positioned to thrive in the Trump 2.0 era.

Disclaimer: This article provides general insights and should not be construed as personalized financial advice. Please consult your wealth advisor for tailored recommendations.