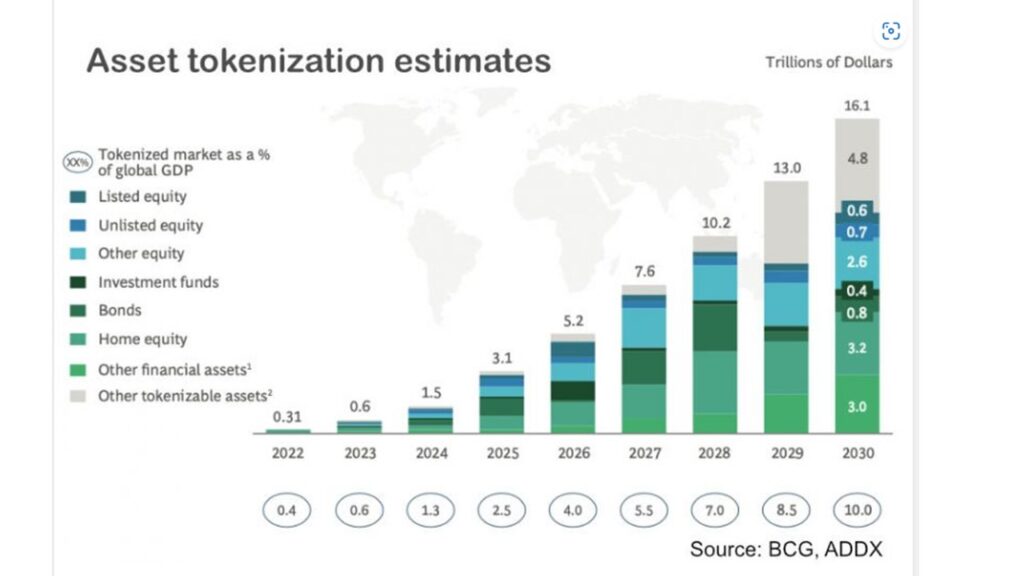

As blockchain technology continues to mature, asset tokenization has emerged as one of its most compelling use cases. A report by BCG and ADDX projects that the tokenization of real-world assets (RWA) could grow into a $16.1 trillion market by 2030. This growth is underpinned by an increasing demand for greater liquidity, accessibility, and efficiency in capital markets, driven by innovations like Franklin Templeton’s BENJI and BlackRock’s BUIDL funds.

What is Asset Tokenization?

Tokenization refers to the process of creating digital tokens on a blockchain that represent ownership of real-world assets, such as real estate, private equity, or bonds. This innovation lowers the barriers to entry by allowing fractional ownership and creates liquidity in traditionally illiquid markets. For instance, tokenized assets can be traded around the clock and across borders, offering enhanced accessibility compared to traditional investment channels

BlackRock’s BUIDL: A Key Institutional Example

One of the most significant applications of tokenization is BlackRock’s BUIDL, a tokenized U.S. Treasury fund launched on the Ethereum blockchain. Targeted at institutional investors, BUIDL allows them to earn yield on tokenized U.S. Treasuries while benefiting from instantaneous settlement and 24/7 transferability. This product has been well received, managing over $500 million in assets within months of its launch, showcasing institutional appetite for blockchain-based investment vehicles.

Franklin Templeton’s BENJI: Pioneering Retail Tokenization

Another noteworthy example of tokenization in action is Franklin Templeton’s BENJI, a tokenized U.S. Government Money Fund. Hosted on the Avalanche blockchain, BENJI tokenizes shares of the Franklin OnChain U.S. Government Money Fund. With each share represented by a BENJI token, investors can buy and trade these assets peer-to-peer using stablecoins like USDC. BENJI combines the security and stability of a government money market fund with the liquidity, accessibility, and speed of blockchain technology.

Much like BUIDL, BENJI allows investors to leverage blockchain for enhanced utility. What sets BENJI apart is its retail-friendly approach, accessible through the Benji Investments app. This integration brings traditional financial products into the digital age by lowering investment barriers, making them available to a broader audience. The ability to trade tokenized fund shares in real-time, combined with future potential for secondary market trading, points to the growing significance of tokenization in both institutional and retail markets.

The $16 Trillion Opportunity

BCG’s report anticipates a 50x increase in the value of tokenized assets by 2030, driven by demand for private market investments. Historically, assets like private equity and real estate have been illiquid, available only to institutional investors with large capital. However, tokenization reduces these barriers by allowing fractional ownership, enabling investments from as little as a few thousand dollars instead of millions. The potential for border-less investments, where tokenized assets can be traded internationally, adds to the attractiveness of this technology(

This growth is not limited to traditional assets. Non-conventional assets, such as car fleets and intellectual property, are also being tokenized, signaling that the financial landscape is on the verge of a transformation. By 2030, tokenized assets could represent up to 10% of global GDP, according to BCG’s projections.

A Shift in Institutional Interest

Blockchain-enabled products like BUIDL and BENJI illustrate a growing institutional interest in tokenized assets. As regulatory frameworks around tokenization solidify and blockchain technology continues to prove its efficiency, more institutions are expected to explore these opportunities. The shift has already begun, with institutions like BlackRock and Franklin Templeton taking the lead in developing digital financial products that bridge the gap between traditional assets and the future of finance

Conclusion: A New Era for Investors

The tokenization of RWAs represents a paradigm shift in the way assets are traded and held, providing greater liquidity, lower investment barriers, and broader accessibility. With pioneers like BlackRock and Franklin Templeton leading the charge, tokenization is rapidly evolving from a conceptual innovation to a $16 trillion reality by the end of this decade. Investors who understand and embrace this technology today will be well-positioned to benefit from the immense economic and financial opportunities it presents.

Tokenization is not just a technological advancement—it’s a redefinition of asset ownership and market participation.

Good https://t.ly/tndaA