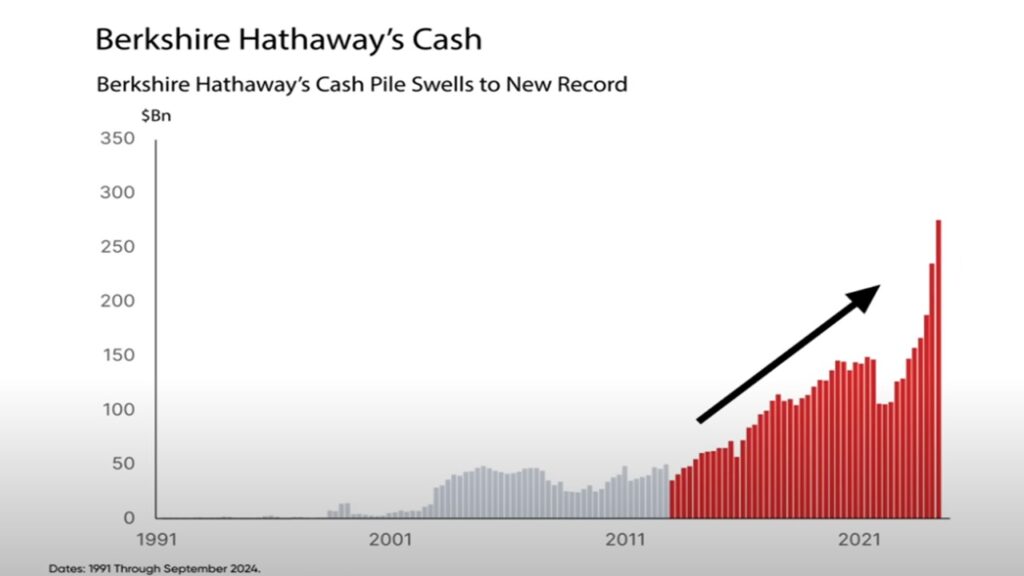

Warren Buffett’s moves don’t whisper—they roar. In 2024, the Oracle of Omaha dumped $133 billion in equities, buying just $5.8 billion back, netting over $127 billion in sales through Q3—likely exceeding $134 billion by year-end. His annual letter, dropped today, February 22, 2025, stays mum on the “why,” but the facts shout: Berkshire Hathaway’s cash pile hit $334 billion, nearly 30% of its assets, a fortress not seen since pre-2008 days. Is Buffett hinting at a market peak, or gearing up for a killer opportunity? Let’s dig in.

While Buffett himself insists he doesn’t time the market based on macroeconomic predictions, pointing to his famous quote, “I can’t recall ever making an acquisition or turning down one based on macro factors,” the deliberate reduction in equity exposure and significant build-up of liquidity begs the question: Is this a calculated repositioning for future opportunities that only Buffett can see, or a subtle, perhaps unintentional, signal about market froth and impending volatility? The implications for your portfolio could be immense.

The Buffett Blueprint: Value Investing Principles in Action

Before dissecting the sell-off, let’s revisit Buffett’s core philosophy. Berkshire Hathaway’s success is built on long-term, value-driven investments in companies with enduring competitive advantages – what Buffett famously calls “economic moats.” He’s a patient investor, rarely swayed by short-term market noise. Therefore, when Berkshire makes a move of this magnitude, it demands closer scrutiny.

The Breakdown: Where Did the Money Go

Reports indicate a significant reduction in equity holdings, most notably a nearly $10 billion trimming of Berkshire’s Apple stake. This is particularly noteworthy given Buffett’s previous praise for Apple as a consumer powerhouse. Further reductions were seen in financial institutions like Bank of America and consumer staples giant Coca-Cola, long-time Berkshire stalwarts. But why these specific moves?

- Apple: Peak Valuation or Shifting Sands? While Apple remains a fundamentally strong company, its high valuation may have prompted Buffett to take profits. The stock has traded at premium multiples, and perhaps Berkshire sees limited upside potential in the near term. Apple’s supply chain only shifted out of China at a slow pace. Will the Trump Administration intensify the geopolitical tensions hinder Apple’s production in the future? Or the behind peer AI strategy reduce Apple’s coming market share?

- Bank of America: Interest Rate Concerns? With interest rates remaining high and potential for credit tightening looming, Buffett may be anticipating increased headwinds for the banking sector. Reducing exposure to Bank of America could be a defensive move against potential loan losses and margin compression.

- Coca-Cola: Changing Consumer Tastes? While Coca-Cola possesses an undeniably strong brand, changing consumer preferences towards healthier alternatives could be a long-term concern. Berkshire might be anticipating slower growth in the beverage giant’s core markets.

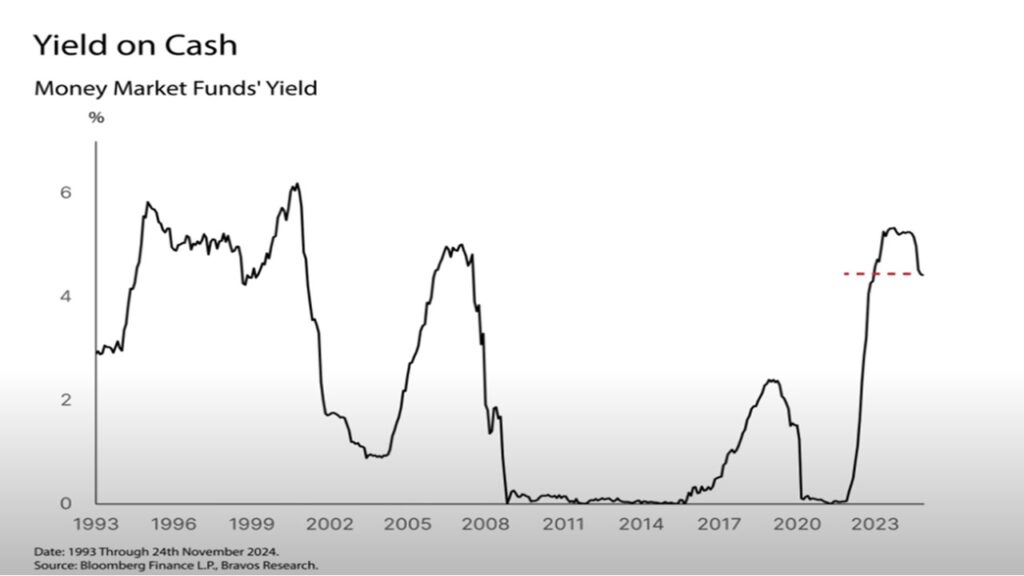

- Yield from cash or cash equivalents decades high ? While Goldman Sachs forecasted the S&P 500 Index could only deliver a 3% annual return for the next 10 years. (According to CNBC, and David Kostin of Goldman Sachs). Putting money in cash or cash equivalents is a sound decision to collect 5% risk free income.

Strategic Rationale: Unpacking the Potential Motives

So, is this a market top signal, or simply shrewd portfolio management? Let’s explore the potential explanations:

- Rebalancing for a New Era: Buffett has historically rebalanced Berkshire’s portfolio to optimize risk-adjusted returns. With some sectors potentially overvalued, he may be redeploying capital towards more attractive opportunities.

- Economic Storm Clouds Gathering: Rising inflation, persistent interest rate uncertainty, and geopolitical risks are creating a complex investment landscape. As Jamie Dimon and others have been vocal about these risks, Buffett may be taking defensive measures to insulate Berkshire from a potential market correction. This massive cash pile provides a cushion and ammunition for future bargain hunting.

- The Value Investor’s Dilemma: Everything’s Expensive! Buffett famously seeks to buy undervalued companies. In today’s market, finding such opportunities is increasingly challenging. Holding cash allows Berkshire to remain patient and wait for more favorable valuations.

- Acquisition on the Horizon? Berkshire has a long history of making large acquisitions. This cash hoard could be earmarked for a significant strategic acquisition, potentially in a sector currently out of favor. Buffett has expressed interest in insurance and infrastructure sectors in the past.

Implications for Your Portfolio: Lessons from the Oracle

While blindly mimicking Buffett’s moves is never advisable, his actions provide valuable insights for all investors:

- Stress-Test Your Portfolio: Re-evaluate your portfolio’s resilience in the face of potential economic headwinds. Are you sufficiently diversified? Are you comfortable with your level of risk?

- Beware of Overvaluation: Identify sectors and stocks that may be trading at unsustainable valuations. Consider rebalancing your portfolio to reduce exposure to these areas.

- Embrace Liquidity: Maintaining a healthy cash position allows you to capitalize on potential market corrections. Be prepared to deploy capital when opportunities arise.

- Revisit Fundamentals: Remember Buffet’s focus is on high quality companies. Avoid speculation, focus on the fundamentals, and invest based on valuation, profitability and long-term growth prospects.

The Final Verdict: Prudence, Not Panic

Buffett’s 2024 equity sell-off is likely a complex interplay of strategic realignment, risk management, and a reflection of the current market environment. While it’s not necessarily a harbinger of doom, it serves as a powerful reminder of the importance of disciplined value investing and prudent risk management. As Buffett himself has said, “Be fearful when others are greedy, and greedy when others are fearful.” Investors should remain informed, stay disciplined, and make calculated decisions based on their individual financial goals and risk tolerance.

What are your thoughts on Buffett’s moves? Share your perspectives in the comments below!

Very good https://dub.sh/LAqZ3qv

Good https://t.ly/tndaA

Good https://t.ly/tndaA

Good https://t.ly/tndaA

Warren Buffett’s recent moves are undeniably bold, with a massive sell-off in equities and a significant increase in cash reserves. His silence on the reasoning behind these actions only adds to the intrigue, leaving investors to speculate on his next move. The reduction in long-term holdings like Apple and Bank of America raises questions about his confidence in these sectors. Could this be a strategic shift to prepare for future opportunities, or is it a subtle warning about market conditions? What do you think Buffett is anticipating? Given the growing economic instability due to the events in the Middle East, many businesses are looking for guaranteed fast and secure payment solutions. Recently, I came across LiberSave (LS) — they promise instant bank transfers with no chargebacks or card verification. It says integration takes 5 minutes and is already being tested in Israel and the UAE. Has anyone actually checked how this works in crisis conditions?