Markets go up and down, trends come and go, and luck can change. But when it comes to creating value in a portfolio company, Private Equity firms have developed repeatable processes that help us make our own luck. This approach is especially relevant today, as evidenced by recent insights from the EY/France Invest report, which highlights a shift towards operational improvements in value creation.

Present Trends and Data (EY/France Invest 2023 Report)

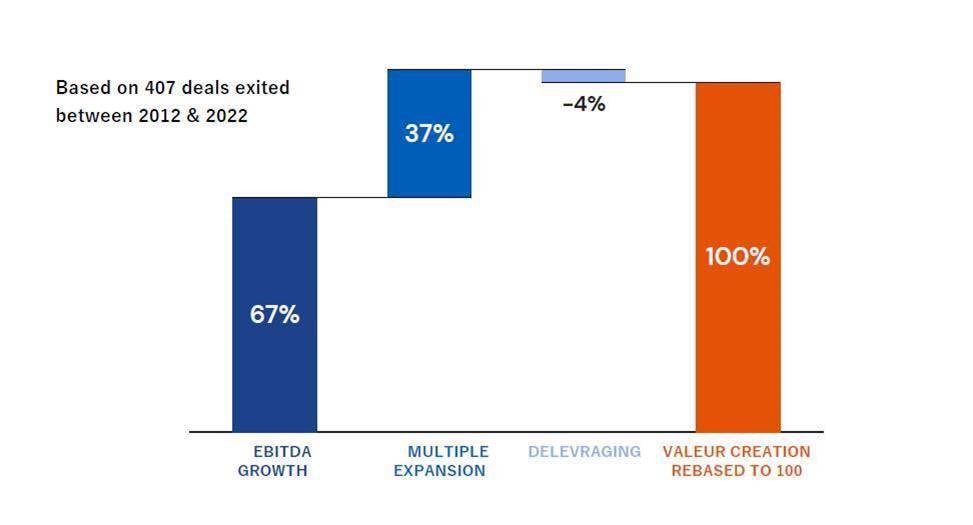

In December 2023, an EY/France Invest report highlighted that 67% of value creation in small and mid-market deals stemmed from EBITDA growth, with 54% driven by organic growth, 32% from build-ups, and 14% from margin expansion. Multiple expansion accounted for only 37%, while leverage had a negative impact, suggesting a clear shift from financial engineering to operational improvements as the primary driver of value creation.

The shifts towards creating value through Operational Improvements

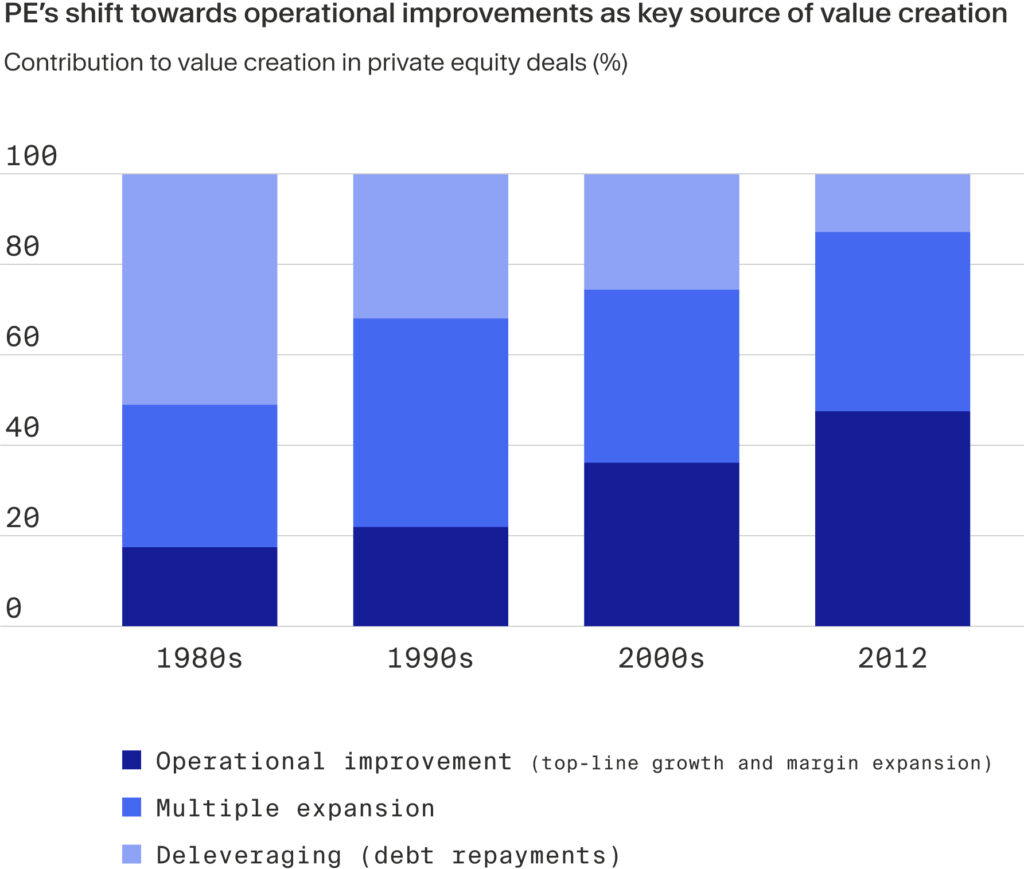

Private equity firms create value in three distinct ways: multiple expansion, leverage and operational improvements. In the 1980s, the primary source of value creation was leverage; since then, the industry moved away from financial engineering in favor of improving the operational performance of the companies it invests in. Many fund managers believe that transforming businesses has the potential to deliver more sustainable and replicable ways to create value in portfolio companies which can, in turn, attract a higher exit premium.

Sources: BCG, Data for the 1980s, 1990s and 2000s was first published in The Advantage of Persistence: How the best private equity firms ‘Beat the Fade’, BCG report, February 2008; data for 2012 is from HHL-BCG research, using a methodology drawn from Oliver Gottschlag, Maurizio Zollo and Nicolaus Loos, “Working out There the Value Lies”, European Capital Journal, 2004

Note: 2012, n=121 deals

Almost all businesses can be improved in some way. Fund managers apply their deep industry expertise to uplift revenue, improve operational efficiency, retain talent, or increase the bottom line before selling upgraded companies for a higher multiple than they were acquired for. In recent years, these strategies have become more hands-on and tailored to each company’s needs and circumstances.

Five cases that deploy various operational levers, with a special focus on Environment, Social and Governance (ESG) considerations and digital transformation.

1 Carlyle’s AZ-EM Transformation (2004)

Carlyle acquired AZ-EM, a division of Clariant, and implemented operational improvements, including streamlining product lines and aggressively managing working capital. These efforts paid off quickly, allowing the company to pay off acquisition debt within three years and achieve a 10x return on investment by selling part of the business.

2 Cinven and Phadia: Diversifying Product Lines

Cinven acquired Phadia and helped it expand its product offering by developing new testing instruments, increasing sales, and enhancing marketing. Despite a recession, these operational changes led to a 50% EBITDA increase, culminating in a lucrative sale to Thermo Fisher with a 3.4x return.

3 Summit Partners and Infor: Buy-and-Build Strategy

Summit Partners acquired Infor and used a buy-and-build strategy to broaden its product offerings, particularly in cloud-based applications. Infor’s customer base grew by 13,000, employee headcount by 3,000, and the company was later sold for nearly $13 billion.

4 CVC and Żabka’s ESG-Driven Growth

CVC’s focus on sustainability at Żabka, Poland’s largest convenience store chain, led to reduced franchisee churn, improved margins, and enhanced environmental initiatives. ESG-driven changes, such as plastic waste reduction and a commitment to net-zero emissions, contributed to a 20% sales increase and 3.9 percentage-point margin growth.

5 Bain Capital and Kantar’s Digital Transformation

Bain Capital assisted Kantar in implementing a digital transformation strategy that streamlined procurement processes, improved risk management, and enhanced operational control. These tech-driven improvements were critical to Kantar’s operational value and market positioning.

Josh Weisenbeck’s Perspective on KKR’s Value Creation Process

Josh Weisenbeck, a Partner at KKR, further underscores the importance of operational improvements. He emphasizes that value creation must be repeatable and within the firm’s control. For KKR, transforming companies—like reshaping Capsugel into a drug delivery business or expanding Bettcher Industries into food automation—enhances both profitability and growth. Weisenbeck highlights KKR’s broad-based employee ownership model and active involvement in operational changes as critical to long-term success, reflecting a hands-on approach in line with the historical examples.

Conclusion: A Growing Focus on Operations

The shift in private equity toward operational improvements, as seen in the recent EY/France Invest data and historical cases, underscores a focus on creating sustainable, long-term value. From Carlyle to KKR, private equity firms continue to refine and implement strategies that go beyond financial engineering, prioritizing operational changes that drive real growth and profitability.

Disclaimers: This content is for informational purposes only. Winfort Capital does not provide investment advice. You should not construe any information or other material provided as legal, tax, investment, financial, or other advice. If you are unsure about anything, you should seek financial advice from an authorised advisor. Past performance is not a reliable guide to future returns. Don’t invest unless you’re prepared to lose all the money you invest. Private equity is a high-risk investment and you are unlikely to be protected from negative market development towards your investment. Subject to eligibility.

Good https://dub.sh/LAqZ3qv

Very good https://t.ly/tndaA